A Helpful Guide: Banking Documents Needed After a Loved One’s Passing

12/22/2025

INB Banking Experts

Share this post on social media

Losing a loved one is one of life’s most difficult experiences. And when you’re steeped in grief, managing financial and administrative matters can feel overwhelming.

At INB, we’re here to support you through this process. When you’re ready, we’ll sit down with you to make sure all finances are in order.

Not sure where to start? We understand.

That’s why we put together a checklist outlining what to bring to the bank when handling the financial and legal affairs of a loved one who has passed away.

Being prepared and knowing what documents and information you might need can help ease some of the stress during this challenging time. Although a lot of information is requested, most of these items are to protect you and your loved ones.

Essential Documents and Information

1. Death Certificate

- When you notify the bank of the death, the account will be frozen until a death certificate is provided.

- Certified copies are often required for banks, insurance companies, and government agencies. Be sure to request multiple copies, as you’ll likely need them for different institutions.

2. Identification

- Your ID and, if available, the deceased’s ID.

- Any legal documents that prove your authority, such as a will, trust, or letters testamentary.

3. Bank Account Information

- Account numbers, statements, checkbooks, and debit/credit cards.

- Information about joint accounts or accounts with payable-on-death (POD) beneficiaries.

4. Insurance Policies

- Life insurance, health insurance, or any other relevant policies.

- Policy numbers and contact information for the insurance providers.

5. Invested Assets

- Investment account statements

- Employer retirement plan and pension statements

- Brokerage account information/statements

6. Property and Other Asset Records

- Deeds, mortgage statements, and vehicle titles.

- Any safe deposit box information or keys.

7. Debts and Obligations

- Credit card statements, loans, and other outstanding obligations.

- Contact information for creditors.

8. Legal Documents

- Wills or trusts

- Estate paperwork or letters of testamentary

- Any other paperwork that may dictate how assets are distributed or managed.

Click here to download this checklist.

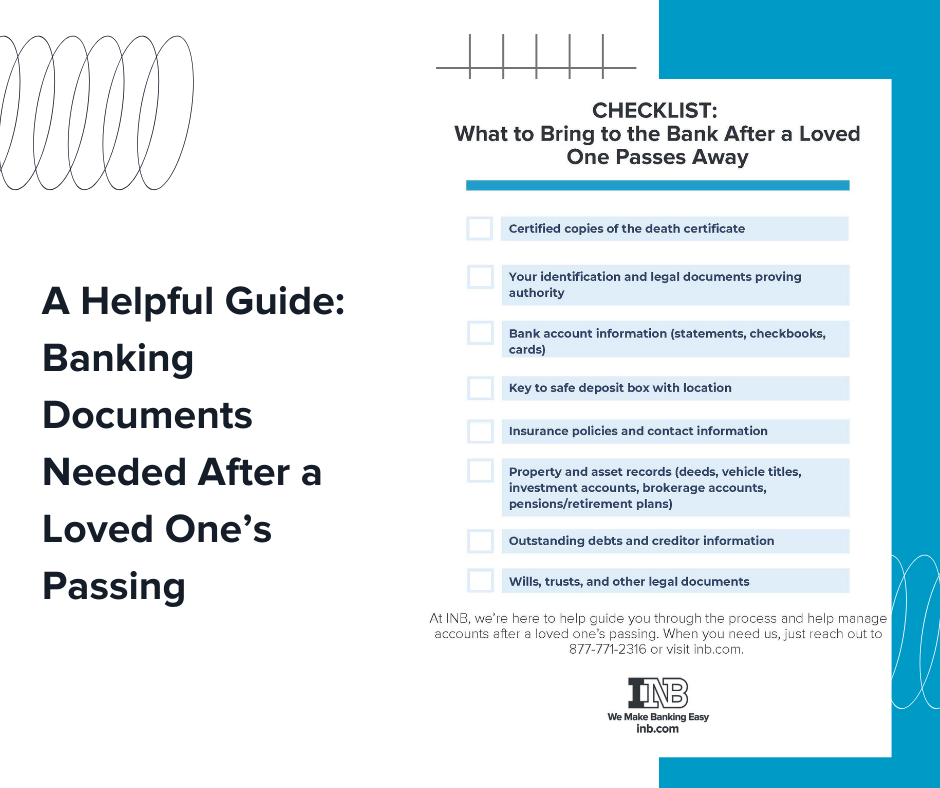

Checklist: What to Bring to the Bank After a Loved One Passes Away

- Certified copies of the death certificate

- Your identification and legal documents proving authority

- Bank account information (statements, checkbooks, cards)

- Key to safe deposit box with location

- Insurance policies and contact information

- Property and asset records (deeds, vehicle titles, investment accounts, brokerage accounts, pensions/retirement plans)

- Outstanding debts and creditor information

- Wills, trusts, and other legal documents

If at all possible, getting organized in advance can give you peace of mind. Keeping a dedicated folder of your loved one’s important financial and legal documents makes this process easier, and estate planning ensures your money goes where you want it to.

At INB, we’re here to help guide you through the process and help manage accounts after a loved one’s passing. When you need us, just reach out to 877-771-2316.