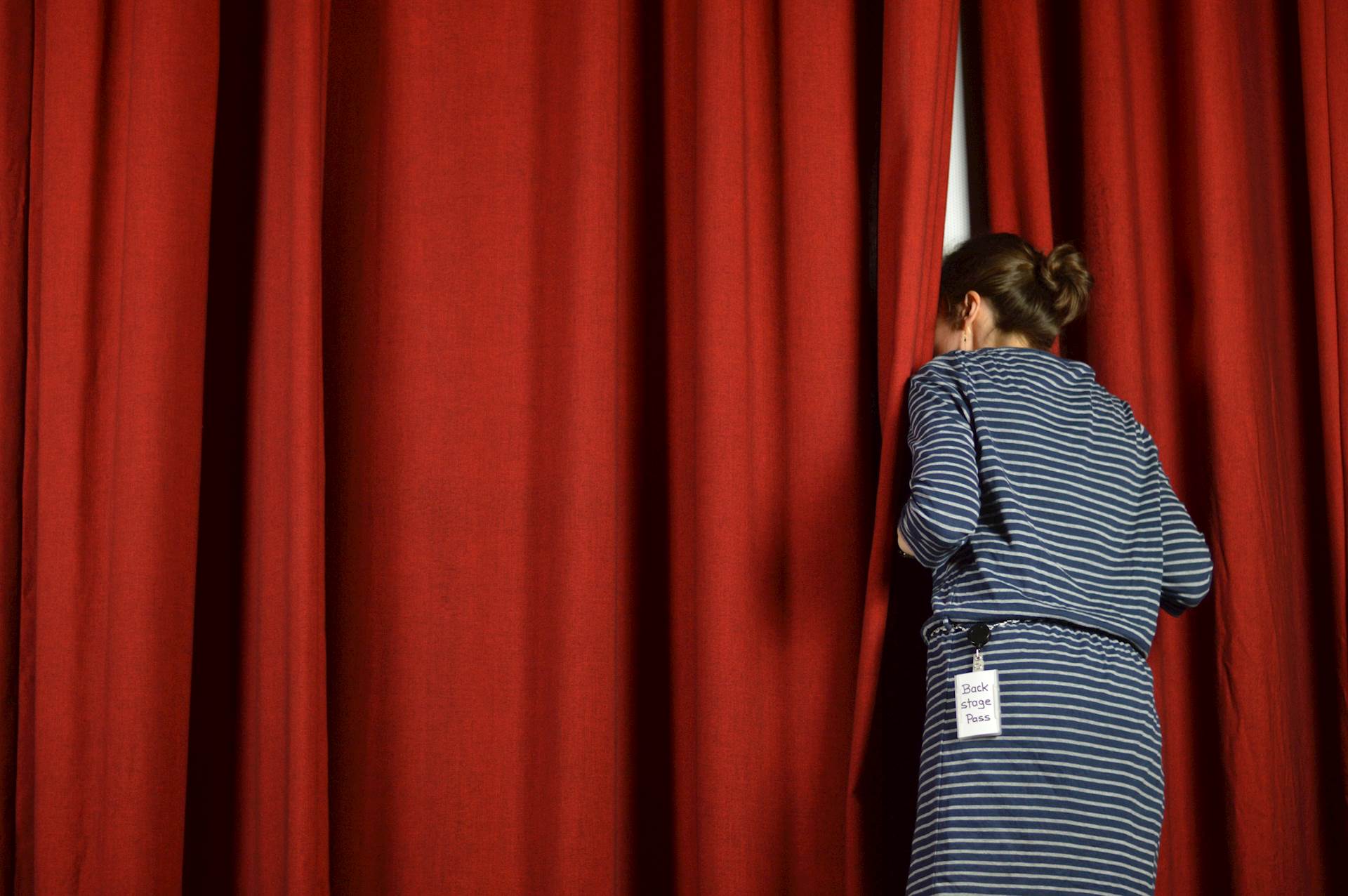

They do the heavy lifting behind the scenes to get local clients into their dream homes. But they’re much more than a simple assembly line.

INB’s mortgage operations department makes it all happen so our homebuyers can get their new keys.

“To a homebuyer, it’s a simple goal: buy a home. But the road map is tricky to get there,” says Gregg Formigoni, vice president, mortgage operations. “We try to make it easier and walk our customers through it, so it’s easy to them, despite any hurdles that might come up.”

Gregg has a “fantastic team” of close to 20 mortgage operations staff who work through the customer’s financial information, home appraisals, title work and more.

“We make sure the puzzle works, and everything can come together to close the loan,” he says.

Guiding You Through the Complex Process

As mortgage processing manager, Samantha Patrick leads INB’s team of processors who handle the mortgage application after it leaves our loan officers’ hands.

This ranges from overseeing the initial application, handling disclosures and terms of application, gathering all necessary documents, and working with the lender, underwriter and other departments to see the mortgage application through to the end.

“The process does take quite a bit of time because of all the documentation required, but my team has a lot of experience, and we’re able to cut through the red tape and cut down on those waiting times for our customers,” Samantha shares.

What Does a Local Mortgage Mean?

Working with a community bank gives you a lot of advantages.

“INB’s asset size means we have stability,” Sam shares. “But we also have a small team that is local so if I have a stumbling block, we can easily switch gears. We have a local leadership team that can discuss these things and make decisions quickly.”

Not only that, but we don’t sell most of our conventional mortgage loans to another financial institution. That’s unique in the mortgage world.

“We take care of our customer – not only for that purchase, but we also service all of our conventional loans for as long as you have the loan,” Gregg says. “If you have a question five or ten years from now, we’re here.”

Although you might never meet them face-to-face, our mortgage operations team at INB all work toward one common goal: to contribute to a positive borrower experience and get you into your new home.

“It’s a big, emotional purchase. People are nervous, trying to coordinate moves,” Sam says. “We come alongside them to make it easier. We’re not just doing purchase transactions – we’re helping people buy a home.”