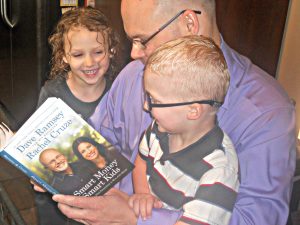

Overspending and debt accumulation seem to have become the culturally accepted norm for many, leading to a downward spiral where families often feel strained by bills and struggle to save for the future. Because of this, financial expert and best-selling author Dave Ramsey and his daughter Rachel Cruze set out to equip parents to teach their children practical and positive money management attitudes and habits in their book Smart Money Smart Kids.

Overspending and debt accumulation seem to have become the culturally accepted norm for many, leading to a downward spiral where families often feel strained by bills and struggle to save for the future. Because of this, financial expert and best-selling author Dave Ramsey and his daughter Rachel Cruze set out to equip parents to teach their children practical and positive money management attitudes and habits in their book Smart Money Smart Kids.

Smart Money Smart Kids is filled with insight about cultivating good money habits from toddlers to teens and beyond, and the book pushes parents to consider all aspects of personal finance when it comes to their family’s financial legacy.

EARNING THROUGH WORK

Teaching children about money starts with work. Ramsey and Cruze point out at the beginning of their book that work is a necessary skill for life, and children need to learn very early that if they don’t work, they don’t get paid.

Throughout each age, parents can give meaningful, age-appropriate jobs to their kids to earn money, teaching valuable life skills.

SPEND, SAVE, GIVE

In Smart Money Smart Kids, Ramsey and Cruze advocate for three core practices of money management that children should learn, which include:

Spending. A focus of learning to spend wisely is teaching our children to weigh the opportunity cost of a purchase, or “if I buy X now, I can’t afford Y later.” Let kids make mistakes when they are young and the “stakes are low;” it’s far better to learn from a $6 mistake than a $6,000, according to the authors.

Saving. Saving money teaches children patience and goal-setting. Saving should be focused on large purchases, emergencies and building wealth. Learning to delay gratification is a tremendous step in building character.

Giving. Ramsey and Cruze believe that all money is God’s money, and we are simply called to be good stewards of what we have. Parents should create opportunities to give as children grow, as well as foster generosity, which means more than just money.

To teach children how to be conscientious in the three categories of spending, saving and giving, Ramsey and Cruze cover topics such as debt, contentment, college expenses, and budgeting. Throughout the book, they remind the reader that children glean from the examples of their parents when it comes to making wise decisions with money.

DEBT

Debt allows you to live better than you can actually afford to do. Credit cards, for example, don’t teach children responsibility; they teach kids to buy what they can’t afford. The authors encourage parents to talk to their kids about how cars depreciate immediately upon purchase, and a car loan is not a necessity in life. “It is a tremendous gift to your kids to show them how to live a debt-free life,” Ramsey writes.

COLLEGE

Ramsey and Cruze encourage parents to work with their children when it comes to paying for college. They discuss all kinds of ways to fund college costs, from exploring different school options to scholarships, saving with educational savings plans, applying for grants, studying hard in high school to earn college credit, getting a job while in college and managing the lifestyle the student lives while in college. The last thing a parent should do is use their retirement funds for their child’s college expenses, Ramsey says.

BUDGETING

The baseline of budgeting is that you tell your money where to go, instead of the other way around. The Spend/Save/Give approach works well for children, but when it comes to teens, it’s time for a more advanced budgeting system.

Ramsey recommends these “five foundations” for teenagers as they earn their own money and learn to provide for themselves:

- Build a $500 emergency fund

- Get out of debt

- Pay cash for a car

- Pay cash for college

- Build wealth and give

CONTENTMENT

However, all of the positive financial habits in the world are only beneficial if a child has contentment. “Content people may not have the best of everything, but they make the best of everything,” Ramsey writes.

Discontentment can be discovered in a child when you begin to see jealousy and envy, anxiety about what they own and wanting more, and defining themselves by their stuff. Cultivating contentment in children is a fight against contemporary culture, and the Ramsey family offers three ways to safeguard against being harmed by the power of money:

- Recognizing that we are not owners of our money, but instead, managers. We have the responsibility to wisely manage the money that comes into our lives for the benefit of our families and others.

- Realizing that good and bad character traits are magnified as wealth grows.

- Surrounding ourselves with others who have a healthy value system of money.

When Rachel was younger, her dad told her “Money can be a blessing or a curse, and it all depends on our attitude and behaviors with money.” With that in mind, Rachel has come to see that money is a tool to be used for “the good of our families and others in the world.”

As parents, we have the power of passing financial behaviors and attitudes on to our children, and Smart Money Smart Kids is a great resource to use as we guide our children in a healthy direction.